arizona charitable tax credit fund

The Arizona Charitable Tax Credit allows individuals to donate to a qualified Arizona nonprofit organization and claim a dollar-for-dollar state tax credit of up to 400. Marys Food Bank and get all of it back in your Arizona Tax Refund.

Arizona Charitable Tax Credit Guide 2020 St Mary S Food Bank

Marys Food Bank is certified on the.

. The Care Fund is a Qualifying Charitable Organization QCO 20167. Claim the credit on your Arizona state tax form. This tax code allows for donations to.

For tax year 2022 the maximum allowable credit will increase to 1238 for married filing jointly filers or 620 for single married filing separately and heads of household filers. 20113 Arizona Coalition for Tomorrow Charitable Fund Inc. Contributions to Qualifying Charitable Organizations.

The Arizona Charitable Tax Credit allows an individual to donate up to 400 and a couple to donate up to 800 and receive the full amount back when you file your Arizona State Taxes. Start the Process - AZ Tax Credit Funds. The Arizona Charitable Tax Credit was created to help taxpayers support charities that offer services to low-income residents with chronic illnesses or disabilities.

21001 N Tatum Blvd 1630-403 Phoenix AZ 85050 22216 Arizona Community Action Association DBA Wildfire 340 E Palm Ln. With the 2022 Arizona Charitable Tax Credit you can donate up to 800 to St. Also support other charitable.

Contributions to QCOs and QFCOs. Take a Tax Credit on their AZ state return up to 400 dollars each year andor 800 per couple. A portion of the state tax dollars they owe or already paid to an organization that provides help to the working poor - all at no financial cost to themselves.

Claim the charitable deduction on their Federal Tax Return. Make your ARIZONA DOLLAR-FOR-DOLLAR DONATION by April 15th. One for donations to Qualifying Charitable.

Your donation will either reduce the total Arizona state income tax you owe or increase the. Under the Arizona Charitable Tax Credit Law ARS43-1088 donations to Ronald McDonald House Charities of Central and Northern. SandRuby uses the internationally renowned Clubhouse Model of Psychosocial Rehabilitation.

By leveraging the Arizona Charitable Tax Credit you take control of where your tax dollars go. Contributions to Qualifying Foster Care Charitable Organizations Investment in Qualified Small Business Credit The Arizon See more. Arizona Charitable Tax Credit.

Please consider taking advantage of this credit by making a. Click Here Make an Arizona Charitable Tax Credit Gift. Arizona provides two separate tax credits for individuals who make contributions to charitable organizations.

Donate up to 400 single filer and up to. Arizona law allows taxpayers to redirect some of their state taxes to help the poorest in our state. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns.

Make a gift to MOM AZ Health Partnership Fund up to 400 indiv800 married to maximize tax credit benefit. SandRuby is supported by our SandRuby Community Fund. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit.

Arizona Charitable Tax Credit. A tax deduction reduces the amount of income you pay taxes on. The Arizona tax credit donation program differs from a traditional tax credit in several ways.

Foster Care Tax Credit Arizona Friends Of Foster Children Foundation

Arizona Health Partnership Fund Mission Of Mercy Arizona Program

![]()

Qualified Charitable Organizations Az Tax Credit Funds

![]()

Arizona Charitable Tax Credit Ronald Mcdonald House Charities Of Central Northern Arizona

Arizona Charitable Tax Credit Help Us Aster Aging Inc

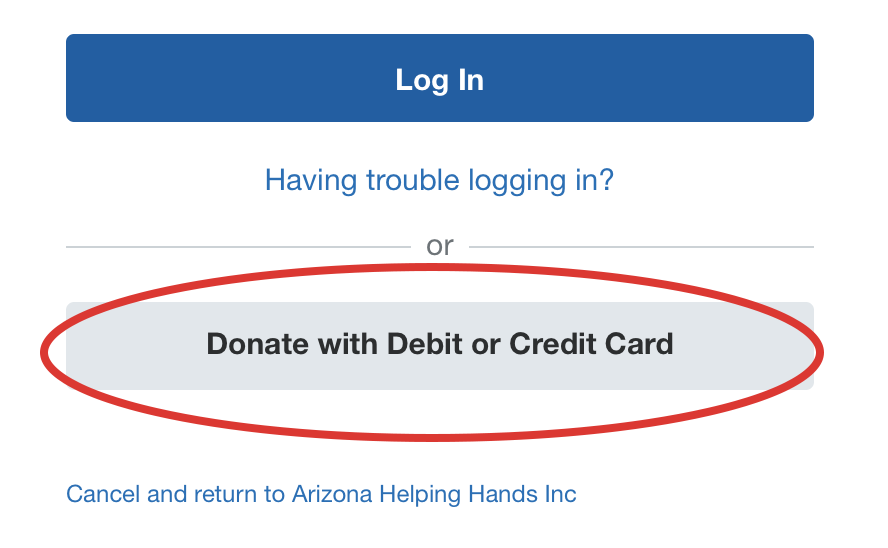

Make A Donation Arizona Helping Hands

Charitable Tax Credit United Food Bank

![]()

Contribute Receive Tax Credit American Leadership Academy Arizona

Az Tax Credit Funds 2020 2021 Tax Credit Guidebook By Frontdoors Media Issuu

Arizona Charitable Tax Credit List 2020

How To Take Advantage Of The Arizona Charitable Tax Credit

Tax Credit Contributions Tax Credit Information

Get Up To An 800 Arizona Charitable Tax Credit Southwest Human Development

Cdt Kids Charity Arizona Tax Credit

Arizona Tax Credits Mesa United Way

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Military Family Relief Fund 2022 Department Of Veterans Services